- Giugno 28, 2022

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

Headquartered in Pennsylvania, Rite Aid (RAD) operates a chain of retail drugstores in the U.S. I am neutral on the stock.

On June 23, 2022, Rite Aid stock jumped nearly 20% in a single trading session, finally breaking above $8 for the first time in two months. It was an extraordinary day, obviously, and casual observers might assume that Rite Aid must be financially firing on all cylinders.

However, forming hasty conclusions without checking the data is a bad habit for any investor to have. Remember, COVID-19 testing and vaccinations might have boosted pharmacy retail industry revenue in 2020 and 2021, but that catalyst has largely faded in 2022. Consequently, Rite Aid has recently had to rely on products and services not related to COVID-19, and that’s easier said than done in a time of high inflation and supply-chain constraints.

At the end of the day, there’s no magic elixir to cure Rite Aid’s problems. Even if the company managed to exceed Wall Street’s expectations and thereby spur a brief relief rally, Rite Aid still has a long way to go to achieve a profitable profile.

On TipRanks, RAD scores a 5 out of 10 on the Smart Score spectrum. This indicates a potential for the stock to perform in-line with the broader market.

Rejecting the Offer

It might seem hard to believe now, but five years ago, RAD was a $60 stock. Even then, the stock had already fallen from a much higher price point, though dip buyers might have hoped for an eventual recovery.

Fast-forward to mid-2022, and Rite Aid’s long-term investors are unfortunately still waiting for that recovery to happen. Shockingly, Rite Aid stock declined to $4.68 a month ago, though the recent recovery to $8 brought some relief to the downtrodden shareholders.

Still, anyone who bought and held Rite Aid during the past few years probably isn’t a happy camper. Some of them might want Rite Aid to get bought out by a company with deep capital reserves. This, if it happens, could provide a much-needed lifeline to the struggling pharmaceutical retailer. Besides, it’s likely that the Rite Aid share price would increase substantially if there’s evidence that the company has accepted a buyout offer.

At the moment, however, there’s no concrete, publicly available proof that Rite Aid is fielding any takeover bids. The company did issue a press release regarding an all-stock acquisition proposal from Spear Point Capital Management. However, apparently Rite Aid’s board of directors concluded that the proposal “was not credible and did not warrant further exploration.”

Did Rite Aid’s board make the right decision? It’s hard to know for certain, but the company claimed that Spear Point’s proposal “provided no evidence of financing, required multiple months of exclusivity and then called for Rite Aid to spend months soliciting competing offers.” Hence, the buyout bid was a non-starter and any serious takeover talk was silenced at that time.

Is the Glass Really Half-Full?

Without any confirmed prospects of a takeover, Rite Aid’s stockholders were in desperate need of a positive catalyst. Evidently they got one on June 23, at least in the short term, as Rite Aid released the company’s first-quarter fiscal 2023 results.

The trading community seems to have taken a glass-half-full view of the results. After all, they made an unmistakable statement when they pushed the Rite Aid share price up nearly 20%.

Is the glass really half-full, though? The answer depends on your perspective. It’s definitely a good thing that Rite Aid was able to exceed Wall Street’s expectations for the quarter. According to a FactSet survey, analysts had expected Rite Aid to report Q1 FY2023 revenue of $5.729 billion and an adjusted net earnings loss of 70 cents per share. Thus, Wall Street didn’t have high hopes for Rite Aid.

So, let’s see how Rite Aid’s results measured up to those expectations. Starting with the top line, Rite Aid posted revenue of $6.015, which certainly beat the analysts’ consensus forecast for the quarter. However, this result was less than the prior-year quarter’s $6.161 billion.

Turning now to the bottom line, Rite Aid’s adjusted net loss of 60 cents per share beat the analysts’ estimate by 10 cents. This result may have prompted the stock-price rally, since traders tend to be highly focused on how companies measure up to expectations. Yet, investors should also note that in the prior-year quarter, Rite Aid reported adjusted net income – not a loss – of 38 cents per share.

Wall Street’s Take

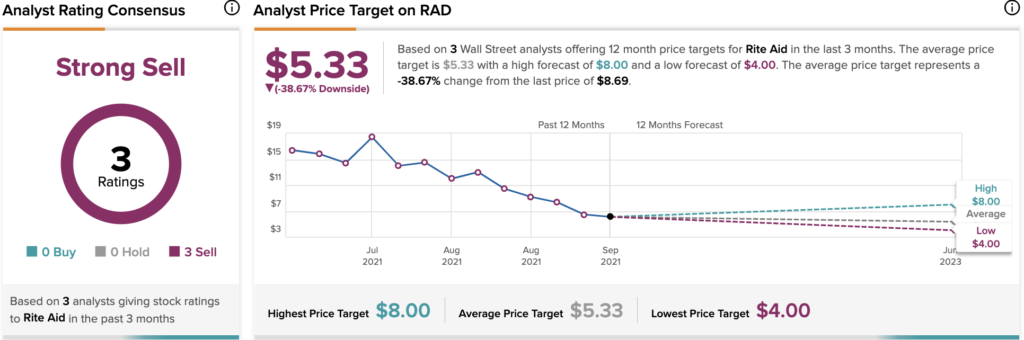

According to TipRanks’ analyst rating consensus, RAD is a Strong Sell, based on three unanimous Sell ratings. The average Rite Aid price target is $5.33, implying 38.67% upside potential.

The Takeaway

Frankly, it’s difficult to take action on Rite Aid stock with confidence. The company’s latest results beat the analysts’ expectations, but those expectations might not have been particularly optimistic. Furthermore, Rite Aid’s performance in Q1 FY2023 is worse than the prior-year quarter’s results.

Only time will tell whether the recent pop in Rite Aid stock will run out of steam. It might just end up being a head-fake, and this wouldn’t be the first time that hopeful Rite Aid investors were disappointed. Therefore, it’s wise to stand back and leave Rite Aid stock alone for the time being.