- Giugno 27, 2022

- Posted by: Oliver

- Categoria: Franchising, Funding trends

We’ll start with a unique REIT – a real estate investment trust. Innovative Industrial Properties operates in US states that have legalized cannabis for medical and/or recreational use, and have established the regulatory apparatus to oversee this new business sector. As a REIT, Innovative owns, operates, leases, and manages a portfolio of cannabis-related properties, mainly industrial-grade greenhouses used as growing facilities in the medical cannabis sector. The company has a total of 64 properties across 19 states.

Innovative’s stock peaked in November of last year, and the shares have been slipping since. Year-to-date, IIPR is down by 55%.

Even as the stock has fallen, however, the company’s revenues have been rising. While sales fell off from 2020 going into 2021, the company has since posted 5 consecutive sequential quarterly gains. The most recent quarter, 1Q22, showed $64.5 million in total revenue. This was up 50% year-over-year and brought with it $1.32 in diluted EPS, although the bottom-line figure missed the analysts’ expectations of $1.36. Funds from operations, a key metric in the REIT field, came in at $1.86 per share.

That was all enough to support a solid dividend, paid out at $1.75 per common share in the first quarter and recently declared at the same amount for the second quarter. Innovative has raised the dividend 8 times in the past 12 quarters, to keep up with the mostly rising earnings and FFO figures.

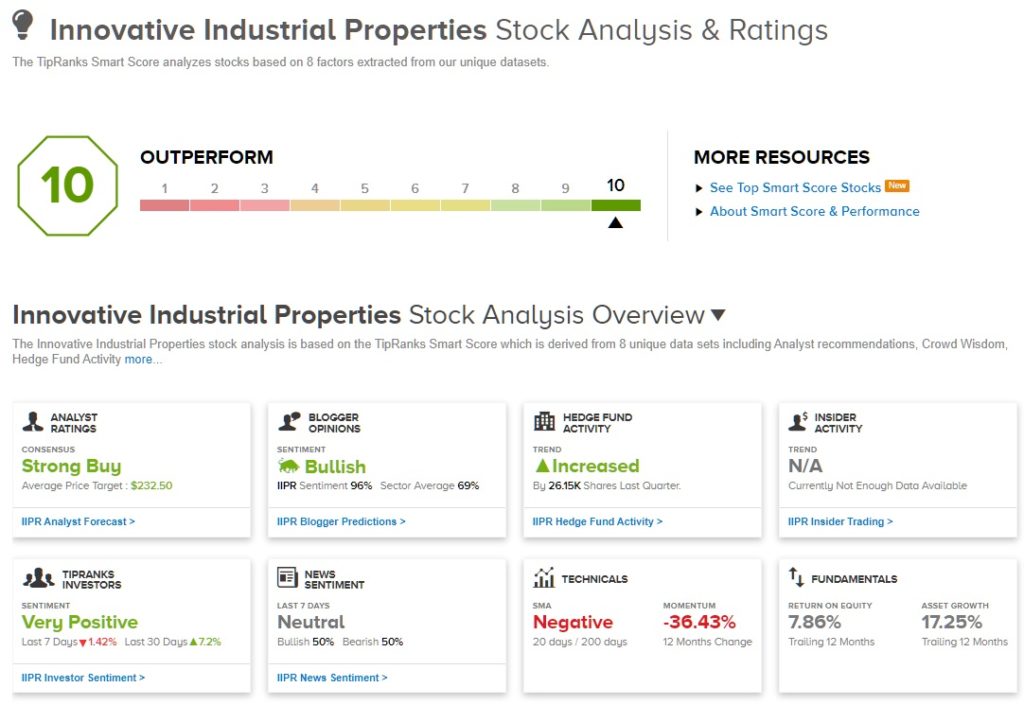

And now we turn to the Smart Score, where Innovative boasts a Perfect 10. A look at the 8 factors shows that a stock can achieve the highest score even if some of the backing data is less than perfect. The technical factors, for example, are negative here. But that is outweighed by 96% bullish sentiment from the financial bloggers and from a significant increase in hedge fund holdings of IIPR in the last quarter.

Craig-Hallum analyst Eric Des Lauriers points out the basic fact that makes Innovative truly unique: that cannabis is still illegal at the Federal level, and that makes it difficult, even in states with legal regimes, for cannabis companies to secure capital funding for building projects. This puts Innovative, which can fund, or simply build, those projects at an advantage. Des Lauriers writes, “With no disruption to any rent payments, low tenant replacement risk, and with these facilities being absolutely ‘mission-critical’ to IIPR’s tenants, we come away from Q1 earnings more confident in the strength of the portfolio. We expect IIPR to maintain a brisk pace of capital deployment ($500-600MM/yr) and growth in AFFO, and with impressive lease terms likely to p

ersist even beyond federal banking reform, we expect IIPR to return to a premium versus peers.”

The analyst’s unabashedly upbeat outlook supports his Buy rating on the stock, as does his $175 price target, which implies a 12-month upside potential of 47%.

Des Lauriers’ colleagues are in full agreement here; all 4 other reviews are positive, making the consensus view a Strong Buy. There are plenty of gains projected too; going by the $232.5 average target, the shares are anticipated to climb 95% higher in the year ahead.