- Giugno 24, 2022

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

Last month, Snap’s (NYSE: SNAP) shares tanked 43% on a single day and dragged down other social media stocks as well. This occurred when CEO, Evan Spiegel, warned that the macro backdrop has deteriorated further and at a faster pace than expected, since the company issued its second-quarter guidance back in April.

Snap is also slowing down the pace of hiring for the rest of the year. Snap’s shares have plunged nearly 73% so far this year.

Snap’s flagship product, Snapchat, is a camera application that enables people communicate visually with friends and family through short videos and images called Snaps. The company generates its revenue through advertising. Persistent macro headwinds have impacted ad spending and an impending recession is expected to bring down ad budgets of companies. Further, Apple’s (AAPL) privacy policy changes and intense competition from Instagram and TikTok are also matters of concern.

Decelerating Growth Rates

Snap’s Q1’22 revenue grew 38% to $1.06 billion, but lagged analysts’ expectations. Also, the company slipped to an adjusted loss per share of $0.02 from break-even earnings in the prior-year quarter. Q1’22 revenue growth reflected a slowdown compared to the 42% and 57% growth in Q4’21 and Q3’21, respectively.

Snap now expects to deliver Q2’22 revenue and adjusted EBITDA below the low end of its previously issued guidance range. It had earlier predicted Q2’22 revenue growth in the range of 20% to 25%, and adjusted EBITDA to be between breakeven and $50 million.

While Snap’s Q2 guidance update was disappointing, the company reassured investors that it remains optimistic about the long-term opportunity to grow its business and increase the average revenue per user.

Snap continues to add new features to drive customer engagement. The company recently disclosed that it is internally testing a new subscription service called Snapchat Plus, which will give Snapchat users early access to experimental features.

Wall Street’s Take

Recently, UBS analyst Lloyd Walmsley slashed the price target for Snap stock to $17 from $45 and maintained a Buy rating, as part of a broader research note on U.S. online advertising companies. Walmsley cited deteriorating ad checks observed last month as well as increasing macro challenges and forex movements to justify his “significantly below consensus” estimates.

Goldman Sachs analyst Eric Sheridan also cut his price target for Snap stock drastically to $25 from $60, and reiterated a Buy rating. The analyst also lowered his forward operating estimates as he feels that Snap is more exposed to a range of macro headwinds given its less diverse advertiser base and sector exposure.

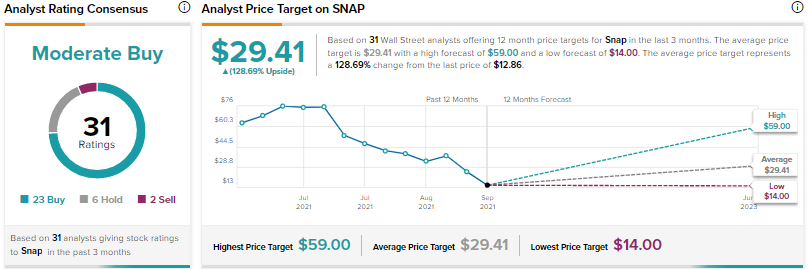

Overall, the Street is cautiously optimistic on the stock, with a Moderate Buy consensus rating based on 23 Buys, six Holds, and two Sells. The average Snap price target of $29.41 implies 128.69% upside potential from current levels.

Conclusion

Macro headwinds are likely to continue to impact digital ad spending and hurt Snap’s growth in the near-term. That said, the majority of Wall Street analysts covering Snap remain optimistic about the company’s growth prospects.