- Giugno 22, 2022

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

Citigroup is a financial services holding company that provides a broad range of consumer and credit banking, securities brokerage, corporate and investment banking, trade and securities services, and wealth management.

In Q1, Citi’s net revenues declined 2% year-over-year to $19.2 billion, beating analysts’ estimate of $1.1 billion. Also, net income dropped 46% year-over-year to $2.02 per diluted share but still came in ahead of consensus estimates of $1.43 per share.

However, shares of Citi have still tanked 26.3% this year and the stock is currently near its 52-week low of $45.40.

Citigroup CEO Jane Fraser, in the company’s Q1 press release, acknowledged that the macro and geopolitical environment had become more volatile, but the company continues “to see the health and resilience of the U.S. consumer through our cost of credit and their payment rates.”

Andy Morton, Citigroup’s Global Head of markets also addressed the market volatility at a recent Morgan Stanley conference. Morton stated, “Volatility is basically our friend,” and believes that “revenue-wise, we’re currently expecting to come in north of 25% above last year’s same quarter results.”

Citigroup could also benefit from rising interest rates as this could strengthen the company’s debt offerings, in turn expanding the company’s bottom line.

Wall Street analysts believe that Citigroup is undervalued. The stock is currently trading at a 0.6x discount to its book value, suggesting that its asset base isn’t fully priced by the market. Banking stocks are usually strong candidates whenever they trade below their book value.

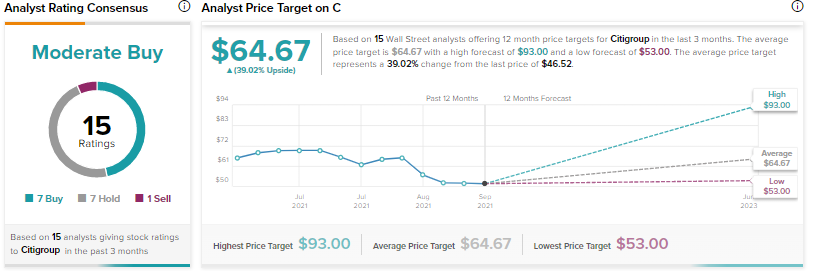

Credit Suisse analyst Susan Roth Katzke, however, downgraded the stock to a Hold from a Buy late last month after the stock came within 10% range of their price target of $58. Katzke’s price target implies an upside potential of 24.7% at current levels and is closer to the lowest price target of $53 on the Street.

The analyst commented, “We realize that the downside to C shares may prove more limited given a valuation within reach of prior cyclical troughs; but we believe the upside, relative to peers, will also prove more limited given the long road ahead in Citi’s transformation process.”

Rest of the analysts on the Street are cautiously optimistic about the stock with a Moderate Buy consensus rating based on seven Buys, seven Holds, and one Sell. The average Citigroup price target of $64.67 implies an upside potential of 39% at current levels.