- Giugno 21, 2022

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

Nokia (NOK) stock is down almost 5% in the past month, but it came in ahead of the S&P 500 (SPX), which declined almost 7%. The robust growth in the communications infrastructure market has benefitted NOK, but high inflationary pressure and supply chain issues have jacked up skepticism among investors. Whether NOK will sustain its outperformance or bounce back remains a conundrum. But the company’s consistent performance and long-term outlook make it more attractive.

NOK is Set to Continue its Growth Journey with more Robust Results

Recently, Nokia published its first-quarter results, and the results were pretty staggering. The company’s revenue rose from $5.38 billion in the first quarter of 2021 to $5.66 billion in the same quarter of 2022. The revenue growth stems from high demand and an improved competitiveness.

According to CEO Pekka Lundmark, “Nokia’s 5G core business continues to steer a strong growth in network and cloud services.”

Despite Nokia’s impeccable sales growth, the company’s cost of goods sold soared, which resulted in a massive drop in margins from 8.5% to 6.6%. As a result of increased cost and operating expenses, NOK’s EPS came in at four cents in 2022, down from almost five cents in the first quarter of 2021.

Nokia’s CEO believes that the cost increase is not a long-term problem since inflation remained a theme throughout the entire first quarter of 2022.

Inflation has indeed affected companies more than ever. But is inflation the only problem the company faces? Certainly not. Recently, Nokia’s mobile network division shrunk by almost 4% due to supply chain shortages.

The company has been facing supply chain issues for quite some time now. But Nokia’s responsiveness to stabilizing the growth suggests that the phone manufacturer is ready to take on challenges.

However, Nokia’s infrastructure division spiked by 9% in the first quarter of 2022. Moreover, its network and cloud services also grew by 5%, entailing that the stock price could increase as the company’s 2022 outlook looks impressive.

On TipRanks, NOK scores a 7 out of 10 on the Smart Score spectrum. This indicates a potential for the stock to perform in-line with the broader market.

Russian Impacts on NOK Stock

Nokia restated its 2022 outlook despite its decision to withdraw from Russian markets because of the Russian invasion of Ukraine. The company made this decision considering western sanctions and the ethical challenges of operating in Russia.

According to Nokia, Russia contributed 2% to the company’s total sales in 2021. Hence, the decision to stop operating there won’t influence Nokia’s revenue, as the company enjoys a high demand across other regions.

Nokia forecasted its comparable operating margin to stand between 11% and 13.5%. Furthermore, the free cash flow is expected to fall in the range of 22-55%. These figures show that the exit loss has little to no impact on Nokia and, therefore, won’t hurt the stock’s worth.

5G is Nokia’s Ticket to Shine

Nokia took its time to renew its spot in the fast-paced tech industry. The company’s business model encountered a three-phase change, which helped Nokia grab a powerful place in the telecommunications market.

Nokia has turned up as a leading 5G player, securing numerous deals throughout the last couple of years. Moreover, the company’s collaboration with Kyndryl is likely to improve automation and result in better systems.

5G is likely to be the company’s turnaround, as Nokia predicts its potential market to equal $128.05 million by the end of 2022. These figures debar China, which could prove to be a game changer for the company.

Many people attribute Nokia’s long-term outperformance to its inclusion in the meme stock frenzy. This could have contributed to the stock’s wild moves in 2021, but it isn’t the sole reason behind NOK’s performance. Nokia’s constant efforts at acquiring 5G deals helped the stock leap out of a slump.

Wall Street’s Take

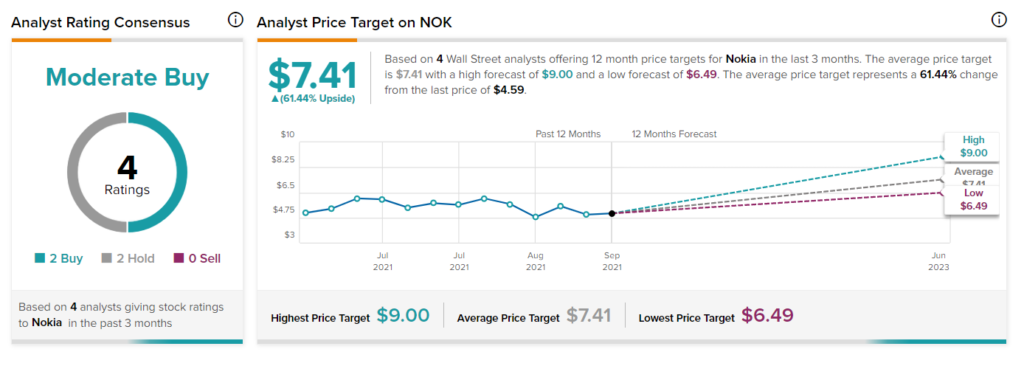

Turning to Wall Street, NOK stock maintains a Moderate Buy consensus rating. Out of four total analyst ratings, two Buys, two Holds ratings were assigned over the past three months.

The average NOK Stock price target is $7.41, implying 61.44% upside potential. Analyst price targets range from a low of $6.49 per share to a high of $9 per share.

Takeaway

Undoubtedly, NOK has increased almost 52% in the last 12 months, and the stock jumped from $5.50 to $6.5 over the previous six months. But, the opportunity isn’t entirely lost yet. A lot in the company could lead to NOK taking a giant leap in the upcoming year. Nokia’s successful repositioning and turnaround efforts have given the potential for the stock to reach multi-decade highs, making it a valuable long-term investment.

At the forefront of its investment story is 5G, which is likely to usher in a new era of growth for the business. Hence, NOK stock remains an attractive idea for long-term players.