- Giugno 21, 2022

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

J.P. Morgan Chase & Co. is a financial services company incorporated in 1968. The bank had $4 trillion worth of assets and $285.9 billion worth of shareholders’ equity as of March 31.

Shares of JPM have fallen 30.1% this year as the company posted mixed Q1 results. However, Evercore analyst Glenn Schorr came away impressed by JPM’s recent Investor Day.

The company’s management stated on its Investor Day that Net Interest Income (NII) for FY22 is expected to exceed $56 billion (excluding its securities trading and brokerage services business), “which takes into account Fed funds reaching 3% by year-end,” loan growth that is projected to be in “high single-digit”, and “modest securities deployment.”

Analyst Schorr pointed out that with trading revenues expected to rise between 10% and 15% year-over-year in Q2, higher loan growth, and a “super benign credit backdrop,” JPM is well-poised to achieve its target of Return on Average Tangible Common Shareholders’ Equity (ROTCE) of 17% in 2022.

ROTCE is frequently used in the case of banks and insurance companies and measures the business performance across time, regardless of whether the business was developed internally or acquired. ROTCE is calculated by dividing net income by the average monthly tangible common shareholders’ equity.

The analyst is also positive about JPM’s longer-term investments, “which should prime the growth pump for years to come.” JPM has ramped up its investment in technology, new products, markets, bankers, and branches this year to $14.7 billion, from $11.1 billion in 2021.

As a result, Schorr reiterated a Buy rating and a price target of $150 on the stock, implying an upside potential of 32.7% at current levels.

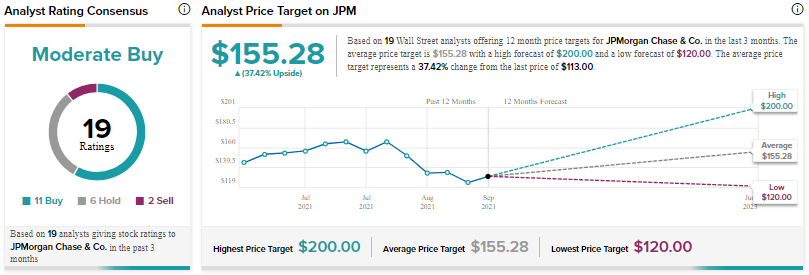

Other analysts on Wall Street are cautiously optimistic about the stock with a Moderate Buy consensus rating based on 11 Buys, six Holds, and two Sells. The average JPM price target of $155.28 implies an upside potential of 37.4% at current levels.