- Giugno 20, 2022

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

Nio shares are down nearly 40% year-to-date due to supply chain pressures and the impact of COVID-led lockdowns on production. Investors were also worried about the potential delisting of several Chinese shares from the U.S. stock exchange, but Nio has now listed its shares on the Singapore and Hong Kong exchanges to mitigate such concerns.

This week, Nio launched its ES7 sports utility vehicle, for which deliveries are expected to commence on August 28. While Nio might continue to be under pressure in the near term due to supply-chain bottlenecks, Wall Street analysts remain optimistic about the electric vehicle (EV) maker’s long-term prospects.

Mizuho analyst Vijay Rakesh believes that battery EVs continue to be a “bright spot” amid macro challenges. Rakesh feels that battery EV sales in May in key EV markets could be recovering well from the impact of lockdowns in March and April. May sales were up 19% month-over-month, driven by China’s rebounding by 80%.

Rakesh highlighted that global battery EV penetration in May increased to about 11.4%, up from 8% in 2021. The analyst believes that while lockdowns in the key China market remain mixed, Shanghai re-opening and government stimulus bode well for a strong second half and could benefit Nio and Tesla (TSLA).

Despite near-term headwinds related to logistics and chip shortages, Rakesh believes that EV secular trends remain strong and Nio, Tesla, and Rivian (RIVN) are all “positioned well.”

Rakesh reiterated a Buy rating on Nio stock with a price target of $55.

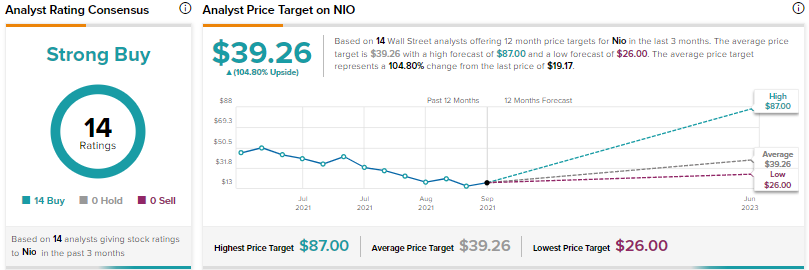

Overall, Nio scores a Strong Buy consensus rating based on 14 unanimous Buys. The average Nio price target of $39.26 implies 104.80% upside potential from current levels.