- Giugno 15, 2022

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

Headquartered in Wisconsin, Kohl’s (KSS) operates retail stores that sell apparel, footwear, and accessories, as well as beauty and home products. I am neutral on the stock.

The e-commerce revolution of the 2010s and 2020s has been absolutely relentless. It was only accelerated by the onset of COVID-19 as lockdowns compelled legions of shoppers to go online. Some companies have profited handsomely from this, while others have struggled.

Kohl’s, which has an online presence but is still primarily known as a brick-and-mortar retail store chain, has definitely struggled due to the advent of e-commerce. Furthermore, persistently high inflation and supply-chain bottlenecks have added to Kohl’s troubles this year.

As we’ll discover, the company’s recently reported financials don’t indicate that a recovery is under way for Kohl’s. However, the press sometimes has a habit of focusing on buyout buzz over hard data, and there’s been talk in the media of a possible imminent takeover of Kohl’s. As a cautious investor, it’s important to keep the established facts top-of-mind and stay on the sidelines until the dust settles.

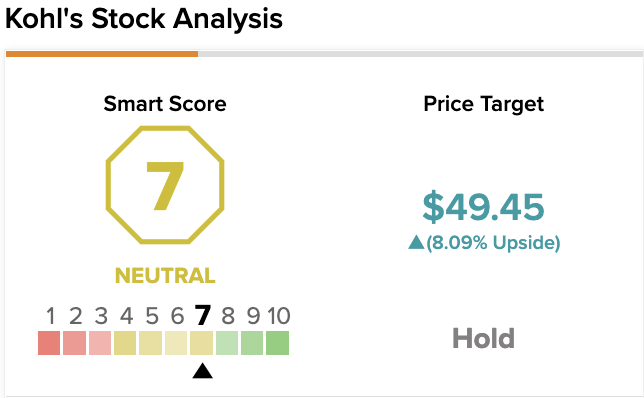

On TipRanks, KSS scores a 7 out of 10 on the Smart Score spectrum. This indicates a potential for the stock to perform in-line with the broader market.

From Interest, to Exclusive Negotiations

For two decades, KSS stock has wobbled and flopped around but essentially gone nowhere. Consider that the Kohl’s share price once traded at $45 in the year 2000, and just recently came back to that same price point.

This isn’t to suggest that Kohl’s investors haven’t garnered any returns along the way. Indeed, the company currently pays forward annual dividend yield of 4.37%. That’s generous, but it’s really just a consolation prize for loyal shareholders if there’s no stock-price appreciation.

What the investors really need, besides dividend distributions, is a reason to believe that Kohl’s stock will finally break through its multi-decade $80 resistance level. Most likely, some shareholders are counting on a buyout of Kohl’s to provide a catalyst for growth and recovery.

The company fueled the flames of takeover talk in April when Kohl’s board “acknowledged receipt of multiple preliminary indications of interest.” However, there wasn’t any firm takeaway for investors yet as the received proposals were “non-binding and without committed financing.”

Fast-forward to June 6, and Kohl’s announced that its board of directors had entered into “exclusive negotiations” with Franchise Group (FRG) to potentially acquire Kohl’s for $60 per share. Before anybody jumps to conclusions, the press release explicitly states that there “can be no assurances that any agreement will be reached.” So, nothing is set in stone here.

In case you’re wondering about Franchise Group, it’s a retail holding company that owns and/or operates, among others, The Vitamin Shoppe and Buddy’s Home Furnishings. The duration of the “exclusive negotiations” between Franchise Group and Kohl’s is set to last for three weeks.

Material Mismanagement

While there’s no guarantee that the acquisition will actually happen, a “person familiar with the matter” reported that Apollo Global Management is “in talks to provide up to $2 billion in debt financing for the potential acquisition,” according to Reuters.

Also, as you may recall, activist hedge fund Macellum Advisors had previously pressured Kohl’s to consider a buyout, with Macellum CEO Jonathan Duskin declaring that Kohl’s executives were “materially mismanaging” the business.

That’s a harsh assessment, but it doesn’t necessarily miss the mark. Everyone’s entitled to have an opinion on the matter, but as the old saying goes, the numbers don’t lie.

So, here’s the breakdown of Kohl’s first-quarter fiscal 2022 financial results. Analysts were anticipating $3.6 billion in revenue and 69 cents per share in adjusted earnings for the quarter. As it turned out, Kohl’s only delivered around $3.7 billion in revenue and adjusted earnings of 11 cents per share.

For full fiscal-year 2022, Kohl’s revised its adjusted earnings outlook from a range of $7 to $7.50 per share, to $6.45 to $6.85 per share. Moreover, the company’s FY2022 net sales are “now expected to be in the range of 0% to 1% as compared to the prior year.”

Unsurprisingly, CEO Michelle Gass cited “macro headwinds” in a statement, which should sound familiar to anyone who habitually reads earnings statements and conference-call transcripts. Certainly, supply-chain issues and inflation have created challenges, and that’s not the fault of Kohl’s management. Nevertheless, in the wake of a disappointing fiscal report, the buck stops with the people in charge at Kohl’s, who can blame macro-level factors but will still be expected to turn the ship around.

Wall Street’s Take

According to TipRanks’ analyst rating consensus, KSS is a Hold, based on five Buy, five Hold, and two Sell ratings. The average Kohl’s price target is $49.45, implying 8.09% upside potential.

The Takeaway

Media headlines can sometimes persuade investors to jump into a trade based on possibilities rather than established facts. Just bear in mind that the saying, “Buy the rumor; sell the news,” could apply to KSS stock as the buyout buzz circulates.

Instead of obsessing over what’s possible, consider the hard data and adjust your investment strategy accordingly. Kohl’s might get bought out soon, or it might not. Either way, the company isn’t delivering the results that the stakeholders should demand. Therefore, it’s wise to stay clear of KSS stock until more information – hopefully, positive – is available.