- Giugno 13, 2022

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

The first stock we’ll look at is SeaSpine Holdings, a medical technology company focusing on the treatment of injuries and disorders of the spine. The company uses a series of advanced materials and techniques to develop a range of surgical implants and procedures, including orthobiologics and spinal fusion hardware, to meet the needs of orthopedic and neurosurgical specialists.

SeaSpine offers solutions for anterior and posterior spinal fusions, along with surgical access and navigation technologies for a wide range of operations. In recent months, the company has announced the commercial launches of new products, such as the Explorer TLIF Oblique TO, Expandable Interbody system, the WaveForm TO system, and the OsteoTorrent DBM product family. These new launches continue SeaSpine’s history of offering best-in-class products.

Last year, SeaSpine moved to shore up its product lines, through the acquisition of Toronto-based 7D Surgical. The acquisition brought 7D’s Flash Navigation into SeaSpine’s range of offerings.

The company’s strong product line supports its growing revenue stream. The company reported $50.7 million in global revenues for 1Q22, up 21% from the year-ago quarter. Of this total, $45.5 million came from US sales. The revenue totals beat the forecast by 3.5%, which helped to compensate for somewhat disappointing earnings in the quarter. EPS was reported at a net loss of 45 cents per share, well below the 36-cent estimate.

SeaSpine had $81.4 million in cash assets on hand at the end of Q1, a total that included $25 million borrowed against an existing credit facility. SeaSpine’s credit limit on that facility was set at $30 million, and the company is negotiating to expand it to $40 million.

Looking ahead, the company is predicting year-over-year revenue growth of 21% to 23% for the full year 2022. This represents an increase of the guidance range by $5 million at the midpoint, to $231 million to $235 million. While the company’s outlook appears positive, its stock shares are down 46% so far this year.

However, Piper Sandler analyst Matt O’Brien thinks this new, lower stock price could offer new investors an opportunity to get into SPNE on the cheap.

“SeaSpine is experiencing strong recovery in volumes following COVID and has seen encouraging signs so far with the launch of 7D. This includes 4 earnouts now signed representing up to $2M of annual revenue as well as some of the first signs of implant pull through in select accounts that have purchased the system outright. Enabling technologies have been a big source of value creation for others in the ortho space, and we expect 7D to provide a similar boost to SPNE,” O’Brien opined.

“Simply put, we believe SPNE has the right leadership and strategy, coupled with an impressive product offering, to continue delivering some of the best growth in spine,” the analyst summed up.

All of that is enough to back up an Overweight (i.e. Buy) rating, and O’Brien’s price target, at $21, implies a one-year upside of 187% for the year ahead.

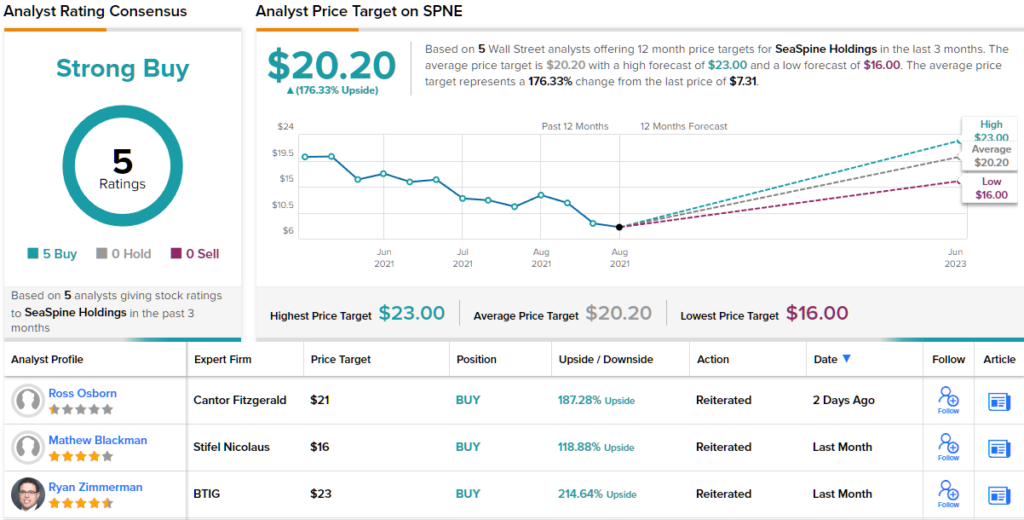

The bulls are out in for this stock, who’s Strong Buy consensus rating is based on 5 unanimously positive analyst reviews. The current share price of $7.31 and the average price target of $20.20 together suggests an upside of 176% for the next 12 months.