- Giugno 8, 2022

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

Air Transport Services Group provides airline operations, aircraft leases, aircraft maintenance, and other support services to the cargo transportation and package delivery industries. The recovery in economic activities like world trade proved to be a boon for the company, as evident from its stock performance throughout the course of this difficult year so far. ATSG stock has gained almost 6% year-to-date.

The company is gaining from strong demand for mid-sized freighters. Moreover, TipRanks also showed us that the general sentiment of corporate insiders regarding the stock is positive based on 13 informative insider transactions by 13 unique insiders over the past three months.

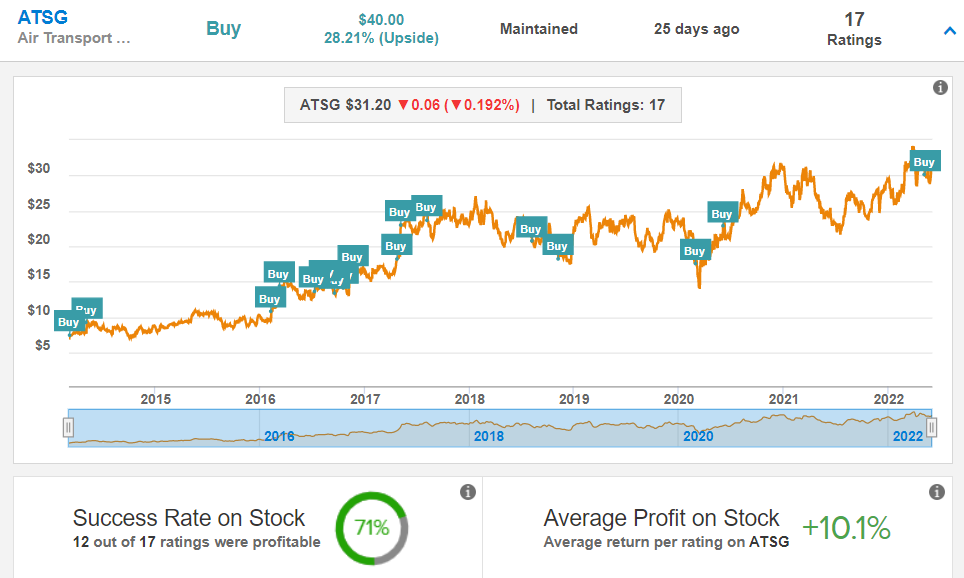

Early in May, Becker reiterated a Buy rating on ATSG stock and also lifted her price target to $40 from $31. Although management reinforced its outlook for 2022 adjusted EBITDA, the projection seems conservative to Becker considering the continued strength in Freighter demand, which is expected to remain strong.

Notably, 12 out of 17 ratings given by Becker for ATSG have been successful, generating an average profit of 10.1% per rating.

Wall Street is also bullish on the stock, with a Strong Buy consensus rating based on three unanimous Buys. The average ATSG price target is $38.33, implying 22.9% upside potential from current levels.