- Giugno 7, 2022

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

China-based Li Auto, Inc. (NASDAQ: LI) is engaged in the designing, production and sale of smart electric vehicles (EV). The company launched its first model Li ONE, a smart electric SUV, in May last year. It started manufacturing the six-seat e-SUV in large numbers in November 2019. Further, the company plans to add battery EVs (BEV) and extended range EVs (EREV) to its portfolio.

Founded in 2015, Li Auto got listed on the Nasdaq in July 2020 and raised $1.1 billion through an initial public offering (IPO). After the listing, the stock price continued to rise and reached an all-time high in November 2020. Thereafter, LI started to fall and reached as low as $15.98 in May last year.

The company, with a market cap of $25.29 billion, announced its first-quarter results last month. Let’s take a closer look at its performance.

Q1 Results

On May 10, Li Auto reported better-than-expected financial results for the first quarter of 2022. Earnings came in at $0.07 per share, compared with the Street’s estimate of a loss of $0.07 per share and the year-ago loss of $0.06 per share.

Total revenues jumped 167.5% year-over-year to $1.51 billion, and vehicle sales rose 168.7% to $1.47 billion. Other sales and services grew 127.2% to $40 million.

Vehicle deliveries climbed 152.1% to 31,716 units, and the gross margin increased to 22.6% from 17.3% in the first quarter of 2021.

CEO’s Take

The Founder, Chairman, and CEO of Li Auto, Xiang Li, said, “While the recent pandemic resurgence and associated supply chain interruptions have been challenging for our industry and uncertainty remains for the near future, we are confident in the resilience of our organization.”

“Despite recent pandemic-related bumps on the road, we are forging ahead with our plan to commence the deliveries of our second model, the L9, in the third quarter. The L9 is a flagship smart SUV for family users based on our new-generation EREV platform, offering best-in-class performance, safety, and intelligence,” Li added.

Q2 Guidance

For the second quarter, the Beijing-based company expects total revenues between $972.3 million and $1.11 billion. Further, vehicle deliveries are expected to range from 21,000 to 24,000 units.

Meanwhile, analysts expect Li Auto to report a loss of $0.08 per share in the second quarter of 2022.

Stock Rating

Following the release of the company’s first-quarter results, US Tiger Securities analyst Bo Pei maintained a Buy rating on the stock with a price target of $40 (52.6% upside potential).

Pei said, “Overall, despite the near-term supply chain issues, we are encouraged by Li Auto’s gross margin improvement. With supply chain restoration and new models, growth should reaccelerate in the second half of the year.”

Overall, the stock has a Strong Buy consensus rating on TipRanks based on six Buys. LI’s average price target of $38.33 implies 46.2% upside potential from current levels.

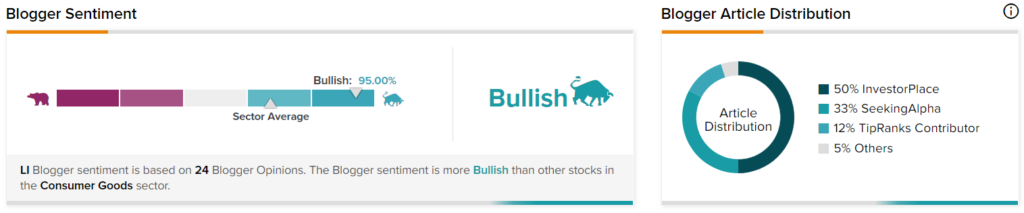

Blogger’s Stance

According to TipRanks, financial bloggers are 95% Bullish on LI, compared to the sector average of 67%.