- Giugno 3, 2022

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

We’ll start with an online fashion retailer. Founded in 2003, Revolve now offers more than 70,000 styles and items in apparel, footwear, accessories, and beauty products. The company uses a data-driven merchandising system, and in 2021 made 87% of its sales at full retail price.

Revolve saw $891 million in net sales last year, up 53% from $580 million in 2020. The strong sales trend is continuing, and even accelerating, this year; the 1Q22 top line came in at $283.5 million, the highest quarterly sales in the last two years – and up 58% year-over-year. The company’s earnings have been more volatile, with diluted EPS ranging from 22 cents per share to 42 cents per share in the past 8 quarters. The 30-cent result in 1Q22 was squarely within this range.

In other positive news from Q1, Revolve Group reported $53.8 million in cash flow from operations for the quarter, of which $52.7 million was free cash flow. The represented gains of 62% y/y, and caps a three-year free cash flow increase of 400%. The company’s strong cash flows are visible in the balance sheet, which holds $270.6 million in cash and liquid asset reserves as of the end of March, up 48% year-over-year.

It’s only natural that an e-commerce firm with strong sales fundamentals would attract notice from major investors, and Fisher, who already held more than 890K shares of RVLV, increased his stake in Q1 by ~811K, to a new total of 1,703,038 shares. At current prices, Fisher has $51.87 million invested in Revolve Group.

Fisher is far from the only bull on this retailer. Wedbush analyst Tom Nikic states, as his bottom line: “We believe the business has compelling growth prospects in the near-term (return to in-person social events) and over the long-term (current customer count only ~3% of the target demographic). Furthermore, we like that RVLV generates highly-profitable growth as well (DD EBIT margins). All in, we remain bullish this name, as one of the more compelling growth stories in our coverage.”

Nikic doesn’t just lay out an upbeat path for the company, he backs it with an Outperform (i.e. Buy) rating and $59 price target. Going by this target, shares are expected to climb ~94% higher over the one-year timeframe.

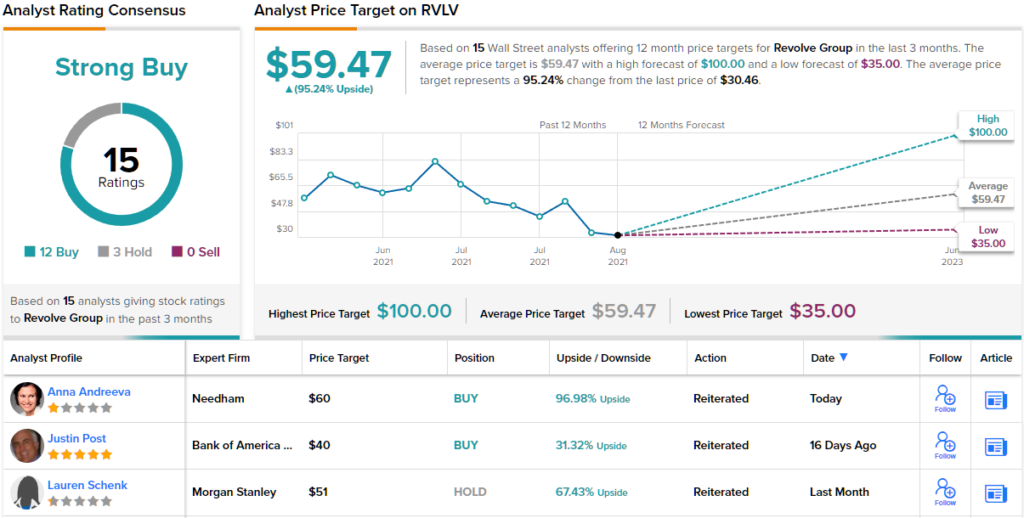

Overall, the analysts generally are willing to take bullish stands of RVLV. Of the 15 recent reviews posted for this stock, 12 are Buys against just 3 Holds, for a Strong Buy consensus rating. The stock is selling for $30.46 and its $59.47 average price target indicates ~95% upside in the next 12 months.