- Giugno 2, 2022

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

The onset of the pandemic in 2020 resulted in a paradigm shift in our behaviors. While offices shifted to our homes, so did learning. Further, it seems this trend is expected to continue even though the onslaught of the pandemic has lessened considerably. This is because online learning is convenient, affordable and offers a plethora of choices.

According to a report by Statista, the global e-learning market, which was at $200 billion in 2019, is expected to reach $243 billion in 2022 and $400 billion by 2026.

One of the prominent players in this burgeoning market is Udemy (NASDAQ: UDMY). Founded in 2010 by Eren Bali, Gagan Biyani, and Oktay Caglar, Udemy is an online learning platform that provides courses for professionals and students.

As of May 2022, the platform had more than 52 million students, 196,000 courses, and 68,000 instructors imparting knowledge in over 75 languages.

In April, Udemy expanded its Asia footprint by launching in South Korea. It also partnered with a Korean AI education company, Woongjin ThinkBig.

According to a Bloomberg report, Udemy got listed on the Nasdaq on October 29, 2021, raising more than $400 million at an average price band of $27-$29 per share. Unfortunately, it has not been a smooth ride for the company, as its stock has plummeted 48.8% since then.

Financial Position

Udemy’s latest first-quarter results were impressive. Its revenues for the quarter stood at $152.2 million, up 22% year-over-year. Meanwhile, the net loss per share narrowed to $0.08 per share from the year-ago loss of $0.21 per share.

Revenue from Udemy Business segment was $64.9 million at the end of the quarter, up 77% year-over-year. The company’s total business customers stood at 11,605 at the end of the quarter, up 49% from the year-ago quarter.

Performance

Udemy scores an 8 out of 10 from TipRanks’ Smart Score rating system, indicating that the stock is likely to outperform the market.

Moreover, TipRanks’ Insider Trading Activity tool shows that Insider Confidence Signal is currently Positive on UDMY, as corporate insiders have bought shares worth $138,200 over this period.

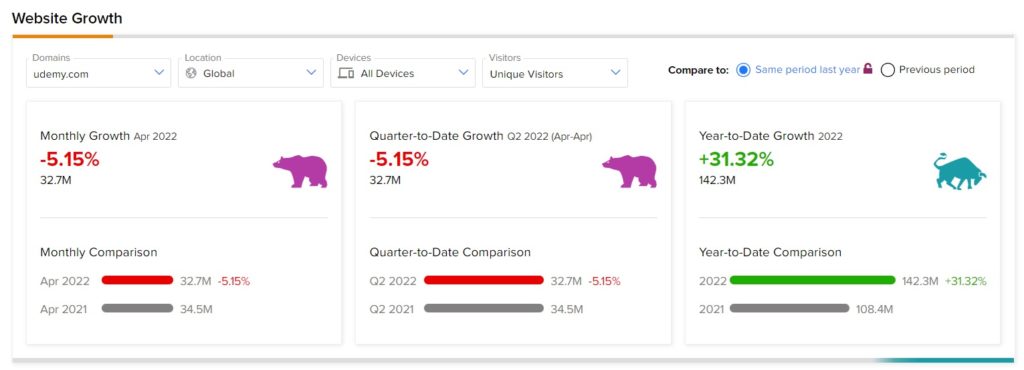

According to TipRanks’ Website Traffic Tool, the footfall on the company’s website has grown 31.32% year-to-date, compared to the previous year.

Also, the financial bloggers on TipRanks are 100% Bullish on UDMY, compared to the sector average of 65%.

Stock Rating

Overall, the Street has a Strong Buy consensus rating on the stock based on seven Buys and two Holds. UDMY’s average price target of $21 implies upside potential of 42.4% from current levels.

Conclusion

Online learning is here to stay, and Udemy is expected to be a key player in this growing industry. Although the company’s stock price has been a wealth destroyer since its IPO, tailwinds like growing revenues, shrinking losses and increasing user base worldwide are expected to stand the company in good stead.