- Maggio 20, 2022

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

Based in San Mateo, CA, Roblox Corporation (NYSE: RBLX) is a video game developer, which developed an eponymous online game platform and game creation system that allow users to program and play games created by other users.

The company was created by David Baszucki, the former CEO of Knowledge Revolution, and Erik Cassel in 2004.

Since its listing in March 2021, the stock is down almost 53.76%, compared to the NYSE Composite index, which is up 49%.

Recent Developments

Despite its dismal stock performance, the company remains well-poised to benefit from its established expertise in the metaverse space.

Recently, Spotify (NYSE: SPOT) became the first music streaming platform to associate with Roblox through Spotify Island, which is a destination in Roblox where both artists and fans interact and get access to exclusive content and virtual merchandise.

Moreover, on April 30th, Roblox hosted its first-ever music awards show in the metaverse with pop star Lizzo.

In February, Roblox partnered with The National Football League to launch NFL Tycoon. With virtual live events taking place throughout the year, NFL Tycoon allows users to build, play, and learn in their own NFL-centered world through a combination of the popular tycoon and simulator genres on Roblox.

Q1 Performance

Roblox’s latest first-quarter results were mixed on a year-over-year basis. Further, both earnings and bookings missed consensus estimates.

While bookings declined year-over-year and missed estimates, the loss per share figure narrowed from the previous year but surpassed estimates.

Further, the company’s average daily active users grew 28% from the previous year to 54.1 million, while hours engaged by users rose 22% year-over-year to 11.8 billion.

Sentiments on TipRanks

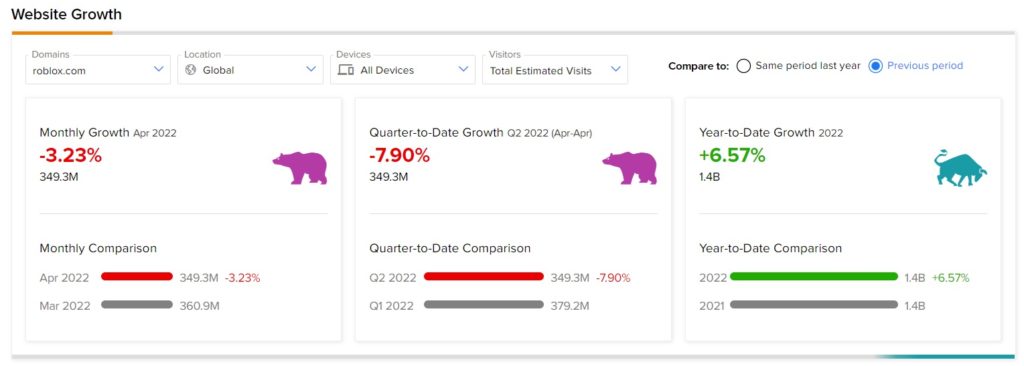

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers insight into Roblox’s performance this quarter.

According to the tool, the Roblox website recorded a 3.23% monthly decline in global visits in April, compared to March. However, the footfall on the company’s website has increased 6.57% year-to-date, compared to the previous year.

Meanwhile, based on informative transactions by four insiders over the past three months, TipRanks’ Insider Trading Activity tool shows that confidence in RBLX is currently Neutral. Corporate Insiders have sold shares worth $2.5 million over this period. Notably over the past 6 months, the top 10% owners of the company have sold shares worth $267 million.

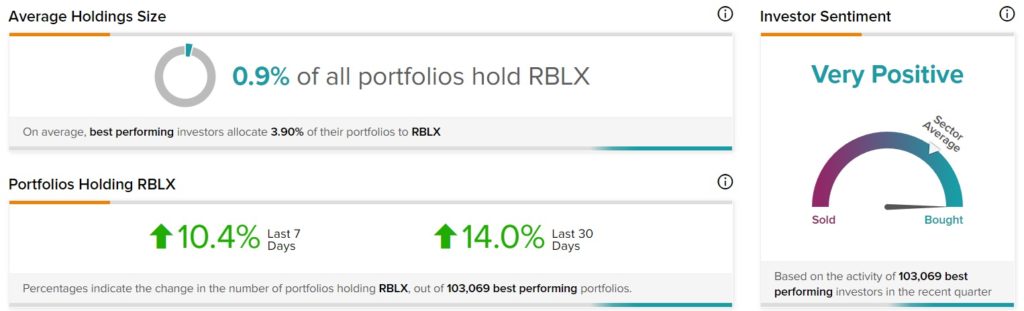

Further, TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on RBLX, as 14% of top portfolios tracked by TipRanks increased their exposure to RBLX stock over the past 30 days.

Price Target

Recently, Stifel Nicolaus analyst Drew Crum reiterated a Buy rating on the stock with a price target of $45, which implies upside potential of 40.9% from current levels.

Overall, the Wall Street community is cautiously optimistic about the stock and has a Moderate Buy consensus rating based on nine Buys, five Holds and one Sell. RBLX’s average price target of $42 implies that the stock has upside potential of 31.5% from current levels. Shares have declined 57.4% over the past year.

Conclusion

Although the company’s financials seem to be a bit shaky and the prevalent onslaught on technology stocks has put Roblox on a back foot, its first-mover advantage in the exciting metaverse space is likely to pave the way for growth.