- Maggio 12, 2022

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

With a market cap of $49 billion, the San Francisco, CA-based company is a financial services and digital payments company, which is spearheaded by former Twitter CEO Jack Dorsey. Earlier known as Square, the payments platform is aimed at serving small and medium businesses.

Block has an allocation of 3.33% in the Best Performing Portfolio on TipRanks.

However, the stock has been a laggard so far this year, down 48.6%, compared to the tech-heavy Nasdaq Composite Index’s decline of 25.9%.

Recently, BMO Capital analyst James Fotheringham reiterated a Buy rating on the stock with a price target of $126, which implies upside potential of 49.3% from current levels.

Overall, the stock has a Strong Buy consensus rating based on 30 Buys and five Holds. Block’s average price target of $162.15 implies upside potential of 92.1% from current levels. Shares have declined 61.8% over the past year.

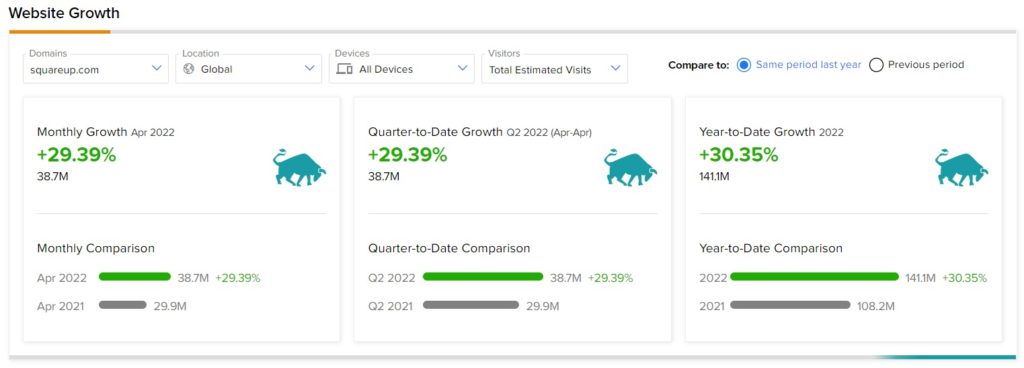

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers insight into Block’s performance this quarter.

According to the tool, the Block website recorded a 29.39% monthly rise in global visits in April against the same period last year. Further, the footfall on the company’s website has increased 30.35% year-to-date, compared to the previous year.