- Maggio 11, 2022

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

The second beaten-down stock we’ll look at is Bill.com, a provider of cloud-based software solutions for the accounting and paperwork issues that threaten to overwhelm the small business world. The company’s cloud platform makes it possible for customers to automate day-to-day processes in billing, invoicing, receiving payments, and making payments, the constant bookkeeping tasks that eat up so much time for small entrepreneurs.

Bill.com is popular among its target customer base of small and medium businesses, as evidenced by the company’s strong revenue growth in recent quarters. Earlier this month, the company released its financial results for fiscal 3Q22, and showed powerful year-over-year revenue growth of 179%, to hit a total of $166.9 million for the quarterly top line. Of that total, subscription fees grew 78% to reach $52.2 million, while transaction fees expanded by 286% to reach $113.3 million.

Even though the financials were, on the surface, solid, the stock fell by a third after the release. Investors were somewhat spooked by a slowdown in revenue growth. Quarter-over-quarter, the top line expanded only 6.6%, a far cry from the 34% q/q growth in fiscal 2Q22. And looking forward, the company gave fiscal Q4 guidance in the range of $182.3 million to $183.3 million, which even at the high end would be q/q growth of less than 10%. To date this year, the stock is down 51%.

Nevertheless, Canaccord’s 5-star analyst Joseph Vafi remains bullish. He writes of this company: “While no one knows the future of the macro right now, we see BILL as being relatively well positioned against the current backdrop, except for its standout valuation, which has clearly already come in materially. With over 70% organic and 179% growth overall in FQ3, no one can say the BILL model does not continue to work on what is a huge, long tail in small businesses that need help with their financial back offices. Also, with 80+% gross margins and a powerful 1-2 punch business model of SaaS subscription and payment volume based revenue, BILL remains the model to beat in SMB payments, in our view.”

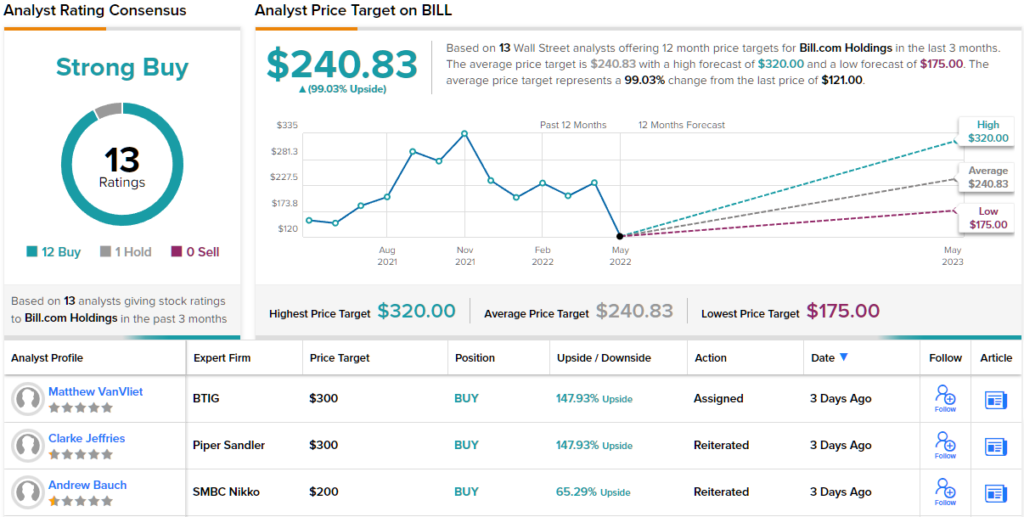

Along with these upbeat comments, Vafi gives BILL a Buy rating and a $250 price target, implying an upside of ~107% over the next 12 months.

Wall Street would tend to agree with this bullish outlook – as shown by the 12 to 1 breakdown in recent reviews, favoring Buys over Holds and supporting a Strong Buy consensus view. The stock is currently trading at $121 and its 240.83 average target suggests an upside of 99% from that level.