- Maggio 2, 2022

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

One of the most prominent trends on Wall Street in 2022 has been to lower expectations. The current uncertain macro environment demands caution what with rising inflation, anticipated interest rate hikes and Russia’s ongoing invasion of Ukraine.

The market has certainly shown it is weary of the developing narrative; the pullbacks have been brutal with many previous high-flyers crashing badly.

So, time to counter all this bearish sentiment and back those which have the wherewithal to withstand the current macro trends. And looking at the case of Advanced Micro Devices (AMD), Raymond James’ Chris Caso thinks the company fits the bill.

“As we have become more concerned about cycle risks given potential for slowing consumer demand and elevated inventory levels at customers, we favor those semi companies with strong secular drivers, more muted cyclical exposure and attractive valuations, for which AMD appears well positioned,” the 5-star explained.

Much of Caso’s bullish outlook for AMD is based on its better positioning compared to rival Intel (INTC). Given AMD’s move to the N5 TSMC node, when the next-generation EPYC server CPU Genoa hits the market in 4Q22, Caso believes the technology gap between the two companies will “widen further.”

Both chip giants already have clearly defined roadmaps and Caso thinks time is on AMD’s side. This is because Intel’s roadmap is not expected to show “parity” with AMD’s before the end of 2024. As such, Caso believes “continued share gains for AMD in datacenter are likely inevitable.” Furthermore, given the current tight supply conditions, Caso thinks clients are likely to commit to AMD to “ensure supply.”

Over time, Caso also believes the PC market will turn into a “sustained duopoly.” Even if Intel does execute its process roadmap “flawlessly,” – which Caso believes is in no way guaranteed – and by 2024/25 manages to get near to AMD’s transistor performance, the analyst still doesn’t think Intel will be able to “maintain” its presently dominant share of the market in client and server.

With

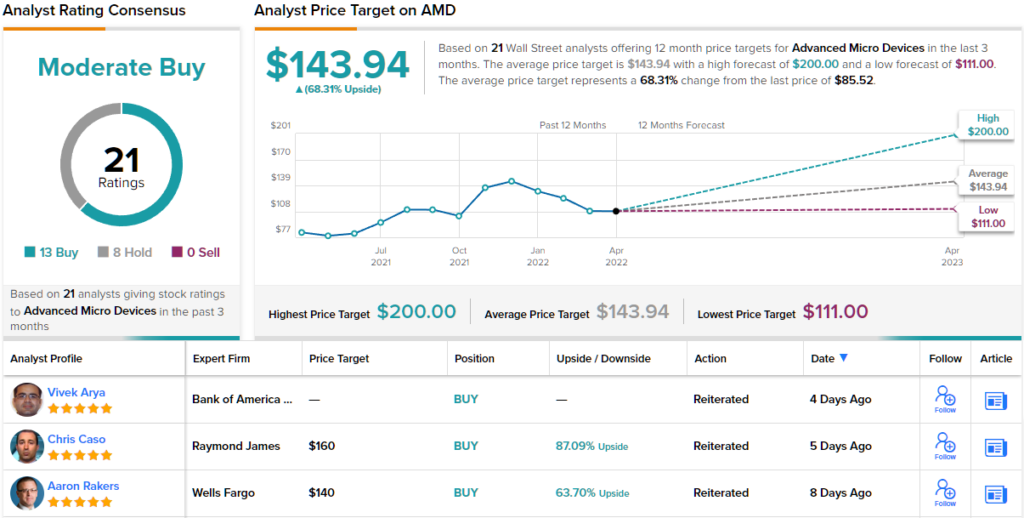

What does the rest of the Street think lies in store for the chipmaker? Based on 13 Buy vs. 8 Holds, the analysts’ view is that AMD stock is a Moderate Buy. The forecast calls for one-year returns of 68%, considering the average price target clocks in at $143.94.