- Aprile 25, 2022

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

For the full year 2021, OneMain reported $9.87 in earnings per share, a strong increase from the $5.41 per share reported for the full year in 2020.

Overall, management was pleased with the 4Q earnings, and expressed that confidence through a 36% increase in the quarterly common share dividend. This payment was bumped up to 95 cents per share, and was paid out in February of this year. With an annualized payment of $3.80, OneMain’s dividend yields 8%.

In coverage for Wells Fargo, 5-star analyst Michael Kaye notes that recession fears have put pressure on OneMain’s stock price recently, but points to a relatively sound position for US consumers – OneMain’s key customer base – as reason for optimism on the stock.

“OneMain shares (along with the consumer finance sector) have been weak on recession fears exacerbated by inflation/higher energy prices. While this certainly contributes to downside risks to the U.S. economy, our belief is that we will avoid tipping into a recession. We think the backdrop for the U.S. consumer remains solid driven in part by a strong employment picture. Thus, we think recession risk ultimately fades, and we view the current share price as a buying opportunity,” Kaye opined.

In line with this comments, Kaye rates OMF stock an Overweight (i.e. Buy), with a $70 price target that indicates room for ~41% upside in the coming year.

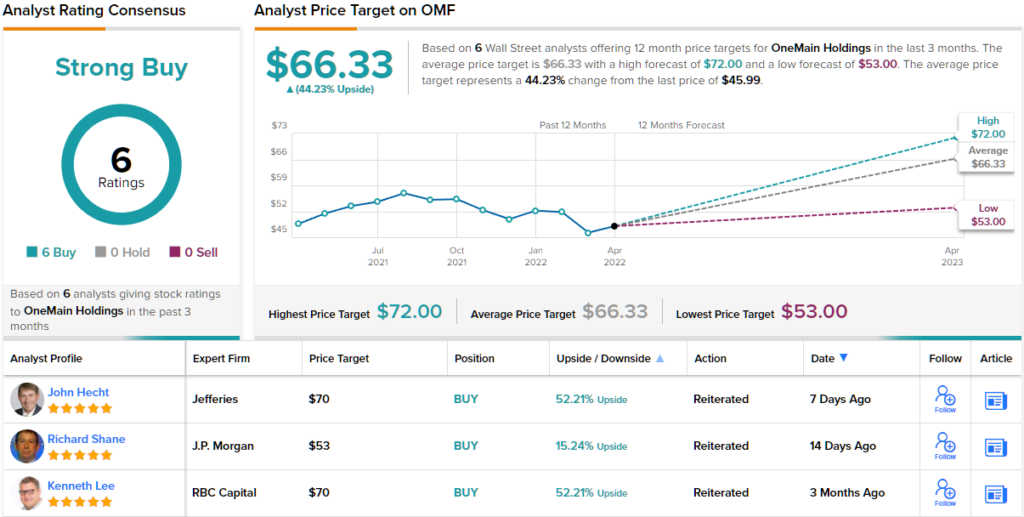

While upbeat, Kaye’s take on OneMain in certainly not an outlier – this stock has a unanimous Strong Buy consensus rating, supported by 6 positive analyst reviews. The shares are priced at $46.09 and their $66.33 average price target suggests an upside of 44% for the year ahead.