- Marzo 31, 2022

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

Micron Technology, Inc. (NASDAQ: MU) posted upbeat second-quarter Fiscal 2022 (ended March 3) results, topping analysts’ expectations on the back of continued data-center sales growth. Remarkably, EPS, revenue, and gross margins exceeded the company’s guidance that was provided in December.

The chipmaker also provided above-expectation third-quarter Fiscal 2022 guidance. Though management expects the war in Ukraine to escalate costs, near-term production volumes are anticipated to remain unaffected by component shortages due to the conflict.

In response to upbeat results, Micron CEO Sanjay Mehrotra commented, “We’re leading the industry in technology across DRAM and NAND, and our product portfolio momentum is accelerating. With outstanding first half results, Micron is on track to deliver record revenue and robust profitability in fiscal 2022.”

Following the update, shares of Micron jumped 3.88% in the extended trading session on Tuesday, after closing 2.74% higher on the day. The company specializes in computer memory and computer data storage processors, including dynamic random-access memory (DRAM), flash memory (NAND), and USB flash drives.

Quarterly Results in Detail

Micron reported Q2 adjusted earnings of $2.14 per share, handily beating the Street’s estimates of $1.97 per share. It reported adjusted earnings of $0.98 per share in the same quarter last year.

Revenue of $7.79 billion surpassed consensus estimates of $7.53 billion and grew 24.8% year-over-year driven by strong sales in client and cloud markets.

Quarterly, DRAM revenue came in at $5.7 billion, up 29% year-over-year, and contributed 73% to the total amount. Additionally, NAND revenue grew 19% to $2 billion, contributing 25%.

Data center revenue was also strong surging around 60% year-over-year, while record automotive revenue was reported on the back of elevated memory and storage demand.

Remarkably, the quarter experienced a recovery in client revenue on the back of strong demand for enterprise PCs. However, slower consumer and Chromebook demand acted as headwinds.

Adjusted gross margin stood at 47.8%, significantly up from 32.9% in the prior-year quarter.

In the quarter, Micron had capital expenditures worth $2.60 billion, resulting with an adjusted free cash flow of $1.03 billion.

Outlook

Encouragingly, Mehrotra said, “Looking ahead, we expect data-center demand growth to outpace the broader memory and storage market over the next decade, fueled by secular drivers in cloud and healthy enterprise IT investment.”

“We anticipate underlying demand in calendar 2022 to be led by data center, ongoing adoption of 5G smartphones and continued strength in automotive and industrial markets,” Mehrotra added.

For Fiscal Q3, the company projects adjusted revenue in the range of $8.5 billion to $8.9 billion, higher than the consensus estimate of $8.06 billion. Moreover, adjusted earnings are expected between $2.36 and $2.56 per share, versus analysts’ expectations of $2.21.

The adjusted gross margin is forecast in the range of 47% to 49%.

Capital Deployment Update

Micron announced a quarterly cash dividend of $0.10 per share, which will be paid on April 26 to shareholders on record as of April 11. The company’s annual dividend of $0.40 per share now reflects a dividend yield of 0.5%.

During the second quarter, Micron repurchased about 4.8 million shares of its common stock for $408 million. Since the inception of the share repurchase program in Fiscal 2019, the company has repurchased 94 million shares at an average price of $50 per share for a total cost of $4.7 billion.

Wall Street’s Take

Following strong second-quarter results, Mizuho Securities analyst Vijay Rakesh reiterated a Buy rating on Micron and increased the price target to $113 (37.72% upside potential) from $110.

Rakesh said, “We see MU well positioned into 2022 with opportunities in data center, PC, and mobile with a potentially improving pricing environment.”

Shares of Micron have rallied 15.73% over the past six months, while the stock still scores a Strong Buy consensus rating, based on 15 unanimous Buys. The average Micron price target of $119.62 implies 45.79% upside potential from current levels.

Investor Wisdom

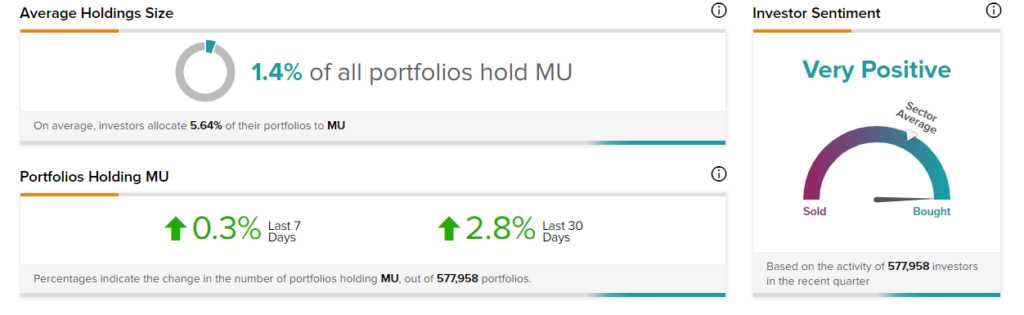

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Micron, with 2.8% of investors maintaining portfolios on TipRanks increasing their exposure to MU stock over the past 30 days.