- Marzo 24, 2022

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

Israel-based SolarEdge is involved in the production of solar power with offerings including power optimizers, inverters, and monitoring portals. The company’s products are used in a broad array of energy market segments including residential, commercial, and large-scale PV, energy storage and backup solutions, electric vehicle (EV) charging, grid services and virtual power plants, batteries, and uninterrupted power supply (UPS) solutions.

The product that differentiates SolarEdge from its competitors is its power optimizers, which enable enhanced cost savings by maximizing the power produced by solar panels.

SolarEdge is a truly global player with operations in more than 133 countries. To date, SEDG boasts of more than 3.5 million inverters and more than 83.9 million power optimizers delivered worldwide.

The company debuted on the NASDAQ in 2015, and yesterday, SEDG completed its underwritten public offering of 2.3 million shares and raised approximately $678.5 million.

SolarEdge has a strong balance sheet with $530 million in cash. With further cash raised, it is well placed for future growth prospects both organically and via acquisitions.

As investors flock to renewable power in times of rising gas prices, SEDG stock is up more than 20% over the past month, against a 22.3% gain over the past year.

According to a Needham report, SolarEdge is expected to post a revenue gain of over 35% for FY22. Non-GAAP earnings of $6.28 per share for FY22 are projected, reflecting growth of over 30% year-over-year.

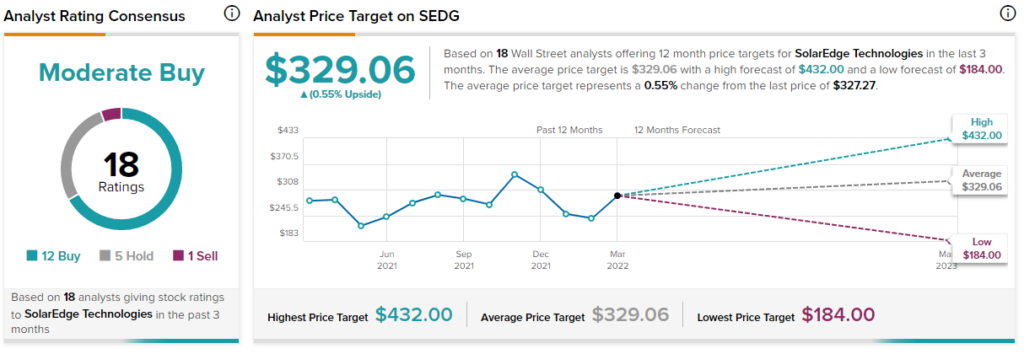

Analysts on the Street are cautiously optimistic about the SEDG stock with a Moderate Buy consensus rating based on 12 Buys, five Holds, and one Sell. The average SolarEdge price target of $329.06 implies, which the stock is almost fully valued at current levels.