- Marzo 23, 2022

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

FedEx Corporation (NYSE: FDX): The $58.7-billion company provides business, transportation, and e-commerce services across multiple nations.

The Memphis, TN-based company’s adjusted earnings increased 32.3% year-over-year in the third quarter of Fiscal 2022 (ended February 28, 2022). Revenues were up 9.8%. For the Fiscal Year 2022 (ending May 2022), FedEx anticipates adjusted earnings to be within the $20.50-$21.50 per share range.

An analyst at Robert W. Baird, Garrett Holland, recently reiterated a Buy rating and the price target of $300 (32.41% upside potential) on FedEx.

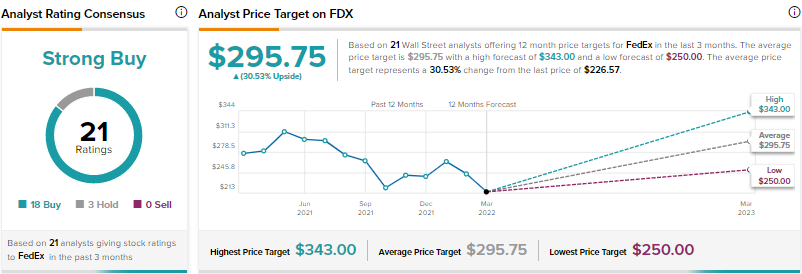

Despite declining 12.7% year-to-date, FedEx has a Strong Buy consensus rating based on 18 Buys and three Holds. FedEx’s average price target is $295.75, mirroring 30.53% upside potential from current levels. The delivery service provider scores a 9 out of 10 on TipRanks’ Smart Score rating system.