- Marzo 4, 2022

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

Harpoon Therapeutics (HARP)

The second stock we’ll look at is another biopharma company, Harpoon Therapeutics. Harpoon is focused on clinical stage immunotherapies, developing T cell based medications for use in the treatment of various cancers. The company has a proprietary development platform, called Tri-specific T cell Activating Construct (TriTAC), with which it is creating an active pipeline featuring five drug candidates and three early discovery tracks.

The company’s four leading drug candidates are at the Phase 1 clinical trial stage, where they are being investigated as treatments for small cell lung cancer, multiple myeloma, ovarian cancer, and prostate cancer. These are serious cancers, with relatively few effective treatments, and large potential patient bases.

In a clinical program update released last month, Harpoon noted that the leading candidate, HPN328, is continuing in the dose escalation portion of the trial. The company aims to have an RP2D determination – that is, an appropriate dose for the expansion stage of the trial – by the end of this year. HPN328 is a potential treatment for small cell lung cancer.

The next trial, of HPN217 for the dangerous hematological cancer multiple myeloma, is also nearing completion of the dose escalation stage. Harpoon is working on selecting the RP2D, and aims to initial the dose expansion cohort of the trial during 1H22.

Finally, HPN536 and HPN424, which are under investigation as treatments for ovarian cancer and prostate cancer respectively, are both undergoing dose escalation studies with completion expected by the end of 2022.

Harpoon has another drug candidate, HPN601, a possible treatment for GI cancers, which is ready to enter the clinical pipeline. The Investigational New Drug (IND) application is expected to be completed for submission by year’s end.

With such an active pipeline, it’s no wonder that Harpoon attracted an investor of Steve Cohen’s caliber. Cohen’s Point72 put $2.66 million into the company, to buy up 650,000 shares in Q4.

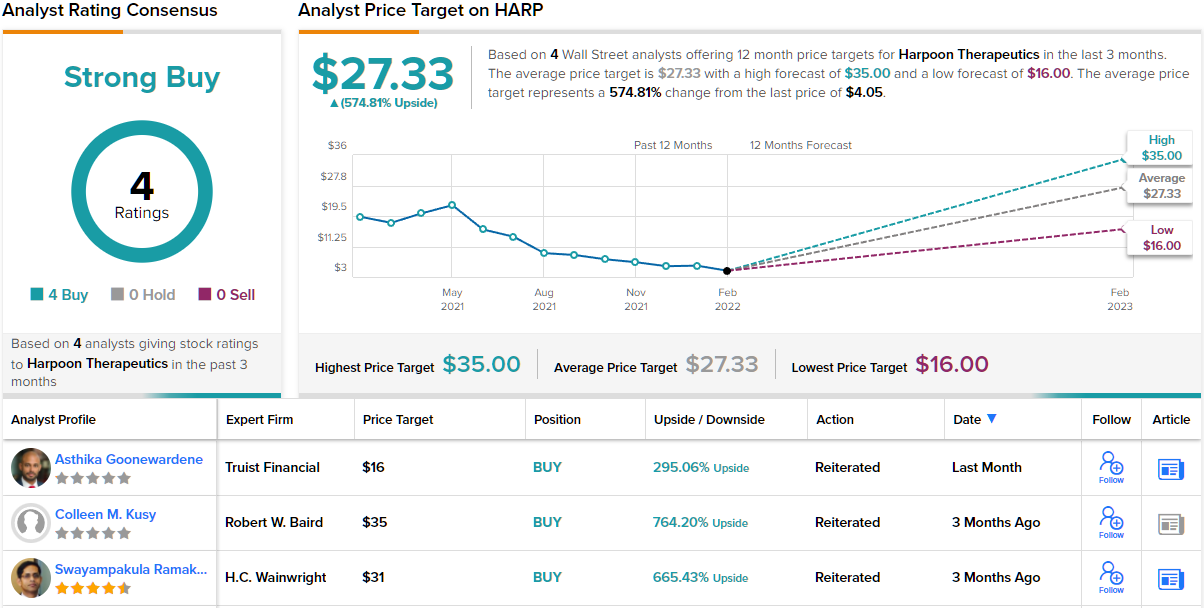

Cohen isn’t the only one bullish here. Truist analyst Asthika Goonewardene gives HARP a Buy rating, with a $16 price target that suggests room for 290% growth in the coming 12 months.

Backing this stance, Goonewardene sees HPN328 as the key, and writes: “After seeing the first look at HPN328 in December, where it achieved 1 confirmed PR (in a SCLC patient dose-increased from 1215µg to 3600µg), and 3 more pts with 21%-38% tumor reduction, we are more positive on the asset, especially given no Gr3+ CRS was reported… Updates from Amgen’s R&D day [also] bode well for Harpoon’s HPN328, in our view. This gives us hope that HPN328 can also show deep responses and clinically meaningful durability in late-line small cell lung cancer (SCLC) – a brutal disease with typically poor outcomes.”

“During our catch up… management stated that they will ‘no doubt’ have additional data this year (targeting a presentation at a medical meeting rather than their planned R&D day), although they were not sure if it would be a 1H or 2H release,” the analyst added.

Overall, Harpoon gets a Strong Buy from the consensus of Wall Street’s analysts, and it’s unanimous, based on 4 positive reviews. The stock is priced at $4.10, with an average target, $27.33, that implies a one-year upside potential of ~575%.