- Febbraio 25, 2022

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

Zoom Video (ZM) will release its fiscal fourth-quarter 2022 earnings on February 28.

The company is one of the top enterprise video communication providers. Its cloud platform supports video and audio conferencing, chat, and webinars across mobile and desktop systems.

Being a cloud-based video conferencing company, tracking user visits to Zoom’s website is crucial for determining the ongoing popularity of its solutions. As Zoom makes the majority of its money through subscriptions to its communications platform, more visits might lead to more subscriptions, resulting in more revenues for the firm, and vice versa.

As a result, we investigated Zoom’s monthly user data, using TipRanks’ new Website Traffic tool, to get a clearer view of the company’s current status ahead of the Q4 print.

Zoom’s Website Visits Showed Declining Trend

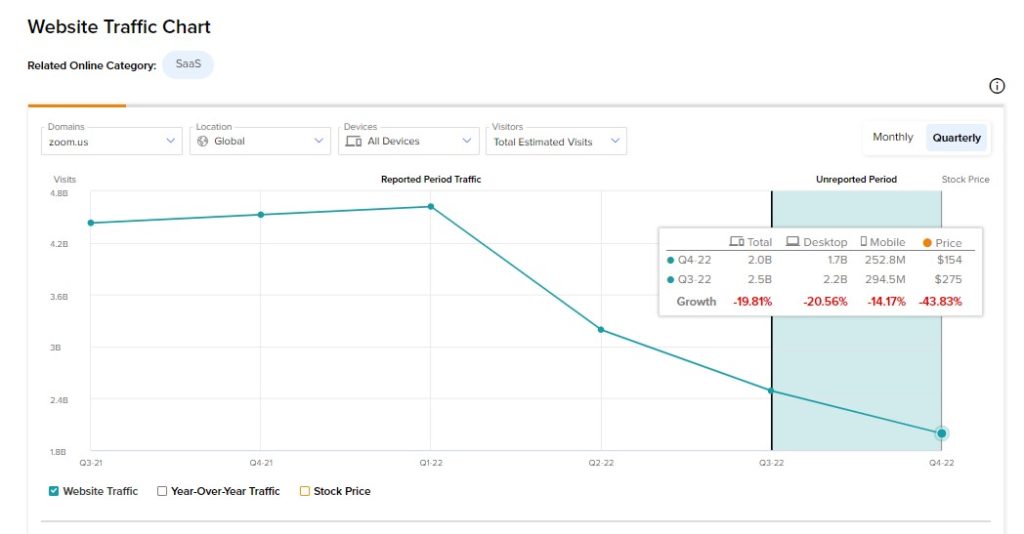

The tool revealed that overall expected visitors to the Zoom website decreased in Q4. Notably, total global visits to zoom.com decreased 19.8% sequentially to 2 billion in the fourth quarter.

According to the graph above, Zoom’s platform has been losing traction as its clients adjust to the changing climate. The drop in monthly visit figures likely indicates that the number of subscribers to Zoom’s platform has fallen compared to the previous quarter. This might have a detrimental impact on top-line revenue and profit margins.

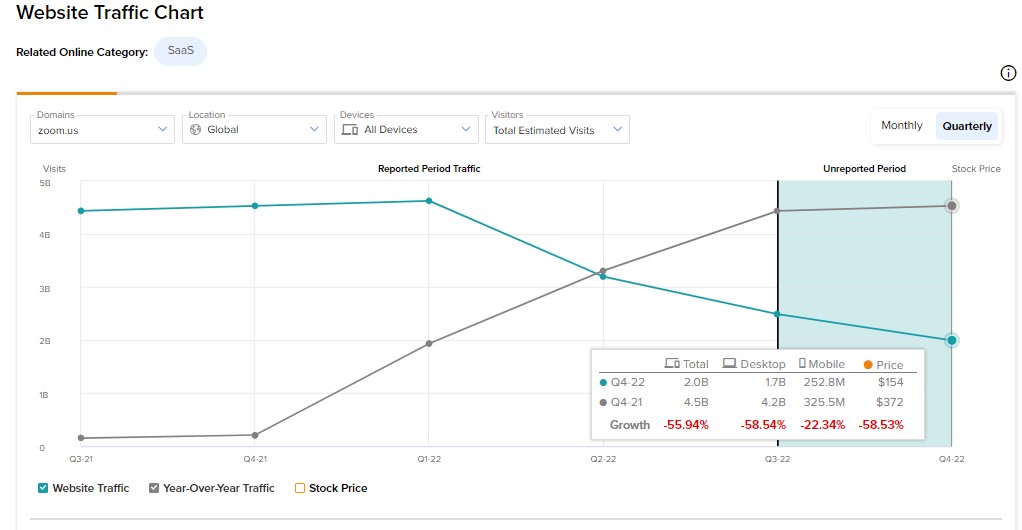

In addition, TipRanks’ new website tool revealed that website visits to zoom.us.com were down 55.9% year-over-year in Q4 2022 compared to Q4 2021.

Zoom, like other lockdown winners, benefited from pandemic tailwinds, but the company has been slipping since the economy has reopened. Over the last year, the stock has dropped by roughly 69%.

Nevertheless, the increase of remote work and the digital revolution are likely to continue, even if it’s fully safe to return to the workplace. As a result, Zoom may still be a good company to invest in, for the long run.

Wall Street’s Take

The Wall Street analysts are cautiously optimistic on Zoom Video, with a Moderate Buy consensus rating based on 8 Buys, 3 Holds, and 1 Sell. The average Zoom stock prediction of $214.79 implies upside potential of approximately 78.8% to current levels for this stock.