- Febbraio 24, 2022

- Posted by: Oliver

- Categoria: Economics, Finance & accounting

The stock market is a constant tug of war between the bulls and the bears. Looking at Palantir’s (PLTR) Q4 performance, Morgan Stanley’s Keith Weiss thinks both had enough to rest their case on.

The bulls could point to “another solid top-line beat” as revenue grew by 34% YoY to reach $433 million, coming in ahead of consensus by 3.6%. Additionally, the total customer count hit 237, far above the analysts’ expectation for 219, while operating margins hit 29%, a “full” 7% points ahead of Wall Street’s forecast.

What’s more, the lack of commercial clients which is often the stick bears use to beat the bulls with may appear somewhat flimsy. US Commercial momentum in Q4 was “very strong,” showing revenue growth of 132% (~80% sans revenues from related SPAC investments). Moreover, the US commercial customer count grew from 17 just 12 months ago to see out the quarter with 80 in total.

So, those are the positives, but the bears have counter arguments here.

Despite signing 64 deals worth more than $1 million in Q4, overall bookings growth (total contract value booked in the quarter) dropped by 6% from the same period last year. Furthermore, Palantir’s SPAC investments accounted for $181 million of the total contract value in the quarter.

And Palantir’s main bread winner is showing worrying signs. The slowdown of government revenue growth continued in Q4, decelerating to 26% year-over-year, down from 34% in Q3 and 66% in Q2.

So, which side of the argument does Weiss take?

“While US Commercial looks to be ramping well (+80% ex-SPAC revenues), it may not have the heft to outweigh a decelerating Government business and sustain a 30%+ growth target,” the 5-star analyst opined. “Add in flat core bookings growth and declining margins for FY22, and the stock likely struggles to regain momentum.”

It’s an Underweight (i.e., Sell) rating from Weiss, although he might as well have said Buy, given the $24 price target suggests shares will climb 129% higher over the coming year. It will be interesting to see whether Weiss revises his rating or price target shortly.

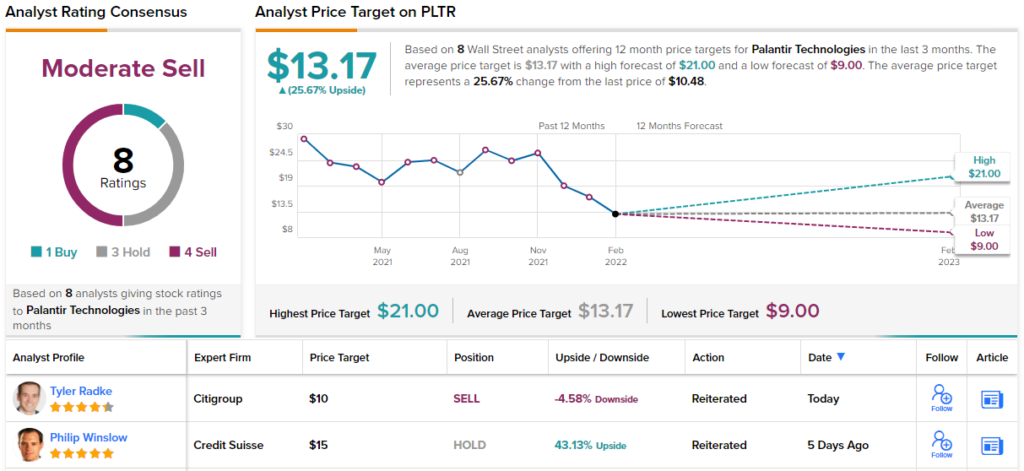

The discrepancy between rating and price target is not quite as acute amongst Weiss’ colleagues though still a little glaring. Based on 3 Sells, 4 Holds, plus 1 Buy, the analyst consensus rates the stock a Moderate Sell. However, considering the average target clocks in at $13.17, shares are anticipated to add 26% of muscle over the next year.